|

Have you ever wondered… Am I spending too much? Will I ever be able to retire? As a matter of fact, I think we can sum it up in a few short words in the form of a question… Does ‘stuff’ own you? You may own ‘stuff’ legally. However, emotionally I see many physicians owned by their ‘stuff’ rather than the other way around. What do I mean by that? Let’s explore 3 signs that you may be owned by your ‘stuff’. Sign# 1: You have high amount of monthly obligations As I look at different physicians that I’ve worked with over the years, they fall into two different camps: there are savers and there are spenders (and of course many of us lie in-between). Check out the best 12 pieces of advice that I could possibly give to either of these groups. The spender physicians are some of the kindest, most wonderful people. They are giving and they are dreamers. They take amazing trips and vacations. They work super hard and play hard. They are also often burdened with a whole bunch of monthly payments. Here are some common examples:

If this resonates with you, here are some immediate actions that you can take to improve your situation:

Sign# 2: You are working a tremendous amount of hours to support your lifestyle Due to all of these obligations, there’s this crushing pressure to perform financially. I’ve seen many of these wonderful people taking on locums opportunities in order to stay ahead. Many of them are working a full-time gig plus locums on the side. They are working more than 80 hours per week and they wonder if they can keep up the pace. As a matter of fact, they are on the fast track to burnout. How can they possibly get off the hamster wheel where they are racing, racing, and racing and never able to get off? Here are some guidelines that may be helpful:

Sign# 3: An early retirement is out of the question Another way to track “does your stuff own you” is by examining if an early retirement may be out of the question. You may be wondering- how do I know if that’s even a possibility? If we go back to our earlier exercise of tracking personal expenses, a simple run of thumb to find out if you can retire today is to…

Here’s another slightly more complex set of rules of thumb to track your progress if you have a significant amount of time away from ‘your number’.

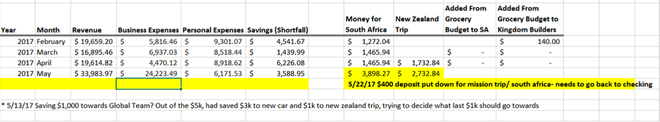

If we look at my situation, we’re averaging $4k/month savings. I’ve got about 14 years (168 months) until target retirement. That’s a total savings of about $672k (with no growth). Our total assets minus liabilities are around $1 million. So, we’re currently quite shy of that goal! 55 might be more realistic for us based on our current savings habits based on these rules of thumb. Keep in mind these are just a couple of simple exercises. Financial planning is significantly more complicated when you take into consideration inflation, growth rates, salaries, taxes, etc. As you do a little bit of math and if retiring by 45 or 50 or 55 is completely out of the question- I suggest that it’s time for us to take a long look in the mirror and re-examining our habits. Did you realize the impact that some small tweaks could have financially? It’s all about putting yourself in the position to succeed.

More Advice by Dave Denniston- The New Retirement and Finances of Business vs. Hobby About the Author

Dave Denniston, Chartered Financial Analyst (CFA), is an author and authority for physicians providing a voice and an advocate for all of the financial issues that doctors deal with. He also has 1 wife, 2 kids, and a bunny named Black Snow (which is a lot better of a name than Yellow Snow). If you’ve enjoyed this guest post, you can learn more about his adventures in financial planning, liquid investments, illiquid investments, & much more nonsense by finding his latest blog post and videos The opinions expressed are those of Dave Denniston and The Capital Advisory Group and are subject to change based on market, tax, and other conditions. The information provided is general in nature. Consult your investment professional regarding your unique situation. Securities offered through United Planners Financial Services 800-966-8737, Member FINRA, SIPC. Advisory Services offered through Capital Advisory Group Advisory Services, LLC. 5270 W. 84th Street, Suite 310, Bloomington, MN 55437, 952-831-8243, United Planners and Capital Advisory Group Advisory Services LLC are not affiliated.

0 Comments

Leave a Reply. |

Career Advice From the Experts and Leaders in Healthcare Careers

Contents

|

Information

|

Stay Connected

|