|

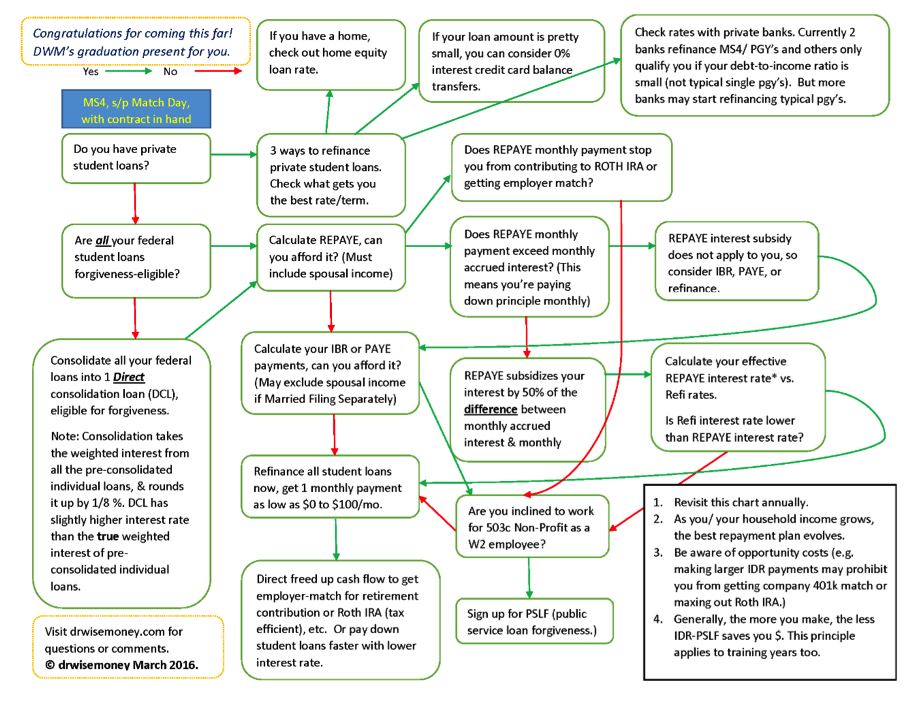

Student Loan Management: Refinance Student Loans or Public Service Loan Forgiveness with Income Driven Repayment Plans by Amanda Liu DO Not only has average educational debt grown drastically more cumbersome over the past decade, but decisions on how to manage one’s student loans have also become much more complex. For the 2016 class of graduating medical students, there are 4 federal income driven repyament (IDR) plans: ICR (Income Contingent Repayment), IBR (Income Based Repayment), PAYE (Pay as You Earn) and REPAYE (Reviwed Pay as You Earn), in addition to standard, graduated, extended repayment plans. Adding further complexity, for the first time in early 2015, residents and fellows are given the opportunity to refinance their federal and private student loans with 2 private banks: LinkCapital (currently out of funds to lend) and DRB. Upon becoming an attending, many more banks are willing to refinance doctors with large debt as well as high income. Here’s a flow chart which summarizes the most beneficial repayment options for a typical post-graduate trainee with high debt-to-income ratio (50-70k income; 200k student debt). These options include IBR, PAYE, REPAYE, & refinancing student loans. Student Loan Management for 4th Year Medical School Students & Post Graduate Trainees (Residents and Fellows) Once you’ve decided to refinance your student loans, rather than going for income-driven-repayment & Public Service Loan Forgiveness, it is critical but challenging to shop for the best interest rate and term. One way to start shopping around includes asking friends for recommendations and applying to multiple banks simultaneously. When you apply to multiple banks within a short period of time, these inquiries will only count as one ding to your credit score. It is understood that you are simply shopping around for a big-ticket item such as student loan refinancing and or home mortgage. I have been paying very close attention to the interest rates and terms that banks are offering for student loan refinancing and this is what my research has shown me. A friend of mine from Touro University in California who is now a practicing pharmacist refinanced her student loans with to a 15-year fixed 3.5% interest rate loan (she refinanced before the feds adjusted the prime rate up by 0.25%; the current 15 year fixed is 3.75%.) She is happy that not only is her interest rate ½ of what she was paying before refinancing her federal student loans, but also the long 15 year term allows her to reserve more cash flow (than a shorter term loan) for retirement savings and down payment for buying a home in California. I am happy to see that there’s finally a break for the medical professionals, especially those living in high cost of living areas such as many cities in California. So I reached out to First Republic Bank, and after several weeks, I heard back from Kerry Berchtold, Relationship Manager at FRB. FRB Rates (March 2016):

*The lowest 5 year fixed rate with CommonBond, DRB, Creidble, or Sofi right now is 3.5%. If you qualify to refinance your student loans with FRB, you get the ONE published rate and term, not an interest rate somewhere in the range of rates offered by most other refinancing banks. For example, my friend with 800+ FICO score refinanced with DRB and got 5.65% interest rate (which initially surprised me as it was at the high end of the advertised range of interest rates for 10 year fixed loan). DRB explained that he didn’t get the low end of the range because his debt/income ratio was high, which is true of most typical PGY's with 200k+ debt and 50-75k in While DRB was the best option for him as a PGY4 (he would not have qualified with FRB due to geographic requirement and debt-to-income ratio requirements by FRB), I definitely encourage him to refinance again, when he becomes an attending. To qualify:

#1: It all hinges on debt-to-income ratio, which differs by individual circumstances. In general, attending physicians can qualify; tougher for PGY’s to qualify but never hurts to find out. #2: You have to live or work in locations FRB have banking branches, which include: California, specifically San Francisco, Palo Alto, Newport Beach, Palm Desert, Los Angeles, San Diego, and Santa Barbara New York, NY Boston, MA Portland, OR Palm Beach, FL Greenwich, CT #3: You Forego Potential Forgiveness such as PSLF like refinancing with other private banks. This loan is a personal, unsecured loan with all that entails. It doesn’t go away if you die (and will be assessed against your estate.) It goes away in bankruptcy. There are no provisions made for unemployment, underemployment, death, or disability. So be sure you have enough life and disability insurance to cover the amount borrowed. #4: $60k-$300k Range: FRB won’t refinance loan amounts lower or higher than this range. If you have 300k+ in student loans, refinance 300k with them to get the lowest rate/best term, and then refinance the excess portion with another bank. If you have less than 60k in student loans, you are in pretty good shape. You can still refinance with other banks like DRB, common bond, Linkcapital, Earnest, etc. Dr. Wise Money (DWM) is a 1st year resident (PGY2) in the Department of Medical Imaging at Banner University Medical Center. As DWM achieves her financial goals of purchasing a home (MS4), paying off student loans (PGY1), & maxing out retirement savings (starting PGY2), she begins writing and giving talks on personal finances for doctors to help her colleagues also achieve financial success. DWM firmly believes that financial freedom makes better and happier doctors. DMW is featured websites including White Coat Investor and nonclinicaldoctors.com. You can follow DWM at drwisemoney.com. Email me at [email protected] for more information.

0 Comments

Leave a Reply. |

Career Advice From the Experts and Leaders in Healthcare Careers

Contents

|

Information

|

Stay Connected

|