What Is Wound Care? Wound care is the subspecialty that provides expertise in the management of acute and chronic wounds. Specialists in wound care focus on evaluating and managing wounds using appropriate interventions and control of co-morbid conditions. These specialists use both surgical and medical skills to the manage wounds. The etiology of these wounds include pressure, arterial, venous, lymphatic, diabetic, traumatic, burns, autoimmune and several other causes. It is estimated that over 6 million people in the United States are afflicted with a chronic wound. As the population ages and the incidence of diabetes increases the demand for physicians skilled in wound care continues to rise. Wound care specialists are trained in managing complex wounds and in leading multidisciplinary teams to deliver comprehensive care. A successful wound care physician is as adept with a scalpel as she is in understanding the mechanisms of a medication that inhibits wound healing. Join Vohra Wound Physicians today. Click here to apply. There are several paths to becoming an expert in wound care and physicians can become a specialist in this area after two years of residency training. Wound care is not yet a recognized board specialty and there are just a handful of fellowships in existence. Many physicians from the backgrounds of general surgery, vascular surgery, internal medicine, plastic surgery, emergency medicine, and family practice become specialized in wound care. Neither the American Board of Medical Specialties (ABMS) or the American Osteopathic Association (AOA) yet recognize wound care as a specialty or subspecialty.

This offers an opportunity for those who have not graduated from residency to serve as experts in a needed area of medicine and one day become part of a new board-certified specialty. If you are interested in:

See availability in your area.

24 Comments

By: Brian Wilson, DO & Kyle Ulveling, MD & Robert F. Priddy

Loss of license is a devastating event for a physician. It's not just the absence of a license and a mechanism for making a living, but the act or issues that led to the revocation of the license. Whether it's malpractice, substance abuse, some alleged egregious administrative act or other, it's a challenge to your professionalism, to your identity and to who and what you've worked your entire life to be. It may seem like the end, but it's not. One of the unfortunate realities of medical practice and the medical profession is that everyone you've encountered, from your first day of medical school to you last day of residency or fellowship, and even on into the "doctors lounge," has expected you to practice medicine until you can no longer work.

Many physicians expect their state medical board members to review their data much like they would a medical record. Objective information is paramount and understanding intent by reading a bit between the lines is only fair, right? Wrong. You’re not being asked to represent yourself and present information, you’re there to defend yourself. An allegation of wrong doing has been made, and it was serious enough for the board to take action to defend its responsibilities, which is protecting the public, and the medical profession against physicians who commit wrong doing, intentional or not, malfeasance or mistake… doesn’t matter. So presenting a defense is very different from an objective presentation of the facts… the facts as you see them and as your supporting documentation may present.

Presenting your defense is based on several factors. The facts represent one factor, but also the context of the facts, and how your facts are delivered to the board represent multiple other factors. Your facts may go beyond the specific event. Past patient interactions may be helpful in creating a fuller, more accurate picture. Supporting staff observations and knowledge of the patient and the situation could be useful. And finally, how you physically present yourself in front of the board is extremely important. How you look, what you say, and how you say it will set the tone for all important first in-person impressions of you. Remember, the real “first impression” was made of you in the complaint. You’re playing catch up from the very beginning. As physician state medical board members, we’ve seen this play out hundreds of time. Some physicians do themselves more harm than good when they show up for a hearing. They may decide they know more than the board members, see their attorney’s instructions as overly controlling and are simply insulted to be called. Others are overly defensive and yet others may be too deferential to adequate defend themselves. We’ve seen guilty physicians convey an air of innocence and the innocent appear guilty. And both guilt and innocence are usually measured in degrees.

If you find a letter from your state medical board in your inbox, don’t panic - prepare. You need to look at your situation critically and consider this a process that demands your serious attention and your ability to take positive steps that involve not only you, but appropriate advisors as well. You need to:

You further as a practicing physician depends greatly on both what you say and how you say it when appearing at a state medical board hearing. Experienced legal counsel is an imperative, but professional support to help you shape your presence and your words can be equally important. Never think that your opinion that you did the right thing and the “right” will win out will be your best defense.

About the author: I provide my clients with what I call a CareerDiagnosis™. It's two days focused on learning about desirable and appropriate career paths to follow. I follow a SOAP note to collect that information. So, you can see, transitioning is a process, but it should be a structured and orderly process that takes you to a positive and rewarding career.

If you'd like to learn more, don't hesitate to contact me for an initial, no-charge, no-obligation Hallway Consult... call/text 720-339-3585or email [email protected]. More advice by Robert Priddy-The Resume Recruiters and HR People Hate, Physician Career Change, Never Overestimate the Knowledge of Your Audience, and Self Protection Is Self Defeating

By Dr. Naval Asija

India’s healthcare has witnessed several transitions in last two decades with a trend towards Privatization, Commercialization and Globalization. This has opened newer avenues for physicians in several industries. Non-clinical positions for physicians now come in different shapes and sizes, with most of them being linked to specific career paths. The traditional types of non-clinical opportunities were more organized and secure; whereas the newer ones offer the promise of faster growth and higher financial rewards, sometimes at the costs of job insecurity and competition from non-physician candidates. Traditional Non-Clinical Opportunities Chief Medical Officer: The CMO is a public servant and is sometimes known as the Civil-Surgeon/Health-Officer. These officers are not directly recruited, but instead, get promoted from the medical officers employed with the government, who are primarily involved in clinical duties in initial few years of their service. Medical Scientist: The medical scientist works with the Indian Council of Medical Research (ICMR) and its affiliated institutes. Since its inception, with a network over 25 research institutes, ICMR has employed scores of medical scientists in bio-medical research. Medical Teacher: Medical teachers are the faculty members in medical colleges that produce fresh medical graduates of modern medicine. They teach basic sciences subjects to medical students, before they get ready for clinical medicine. Besides the medical colleges, medical teachers are also employed by the dental colleges, nursing colleges, and paramedical colleges.

Pharmaceuticals: India is known as the pharmacy of the developing world due to its successful pharma companies. The marketing/sales departments of domestic arms of these companies require services of a medical affairs physician. Similarly, their compliance departments require the services of a regulatory affairs physician.

Information Technology: India has witnessed an IT/BPO services boom over last two decades. The exponential growth of India’s healthcare IT-BPO market and its globalized nature has led to emergence of the role of a med-tech physician who aids in new product development, training of executives and project management. Insurance: India has also seen rapid expansion of private health insurance, and more recently with advent of government provided health coverage schemes the number of insurance beneficiaries and claims have multiplied manifold in last two decades. The physicians employed by the industry take care of the underwriting, authorization and claims processes.

by Robert Priddy

I’m always meeting with clients who are quick to say, just call me Jane or John…., and I always say to them, don’t give up “doctor.” There is a simple reason for that, it’s called credibility. Regardless of how you may feel today when it comes to the respect you receive from staff, colleagues or even patients, Physician is still the top or nearly at the top of any list of the most respected professions in America. So, if you have the ability to walk into nearly any meeting with the expectation of “trust me” already on your side, why would you not? Presenting and selling ideas in business is challenging for everyone. Establishing credibility is a tough job. Becoming a physician is also a tough job, so you’ve earned everything you have. Don’t be afraid or too timid or wishing to just be a part of the gang, to use the trust and the power you’ve earned. In time, once the boundaries have been established, you can drop the “doctor,” if you wish. But initially, use the respect you’ve earned.

If you’d like to learn more, don’t hesitate to contact me for an initial Hallway Consult... Call or Text 720-339-3585 or email [email protected].

More advice by Robert Priddy-The Resume Recruiters and HR People Hate, Physician Career Change, Never Overestimate the Knowledge of Your Audience, and Self Protection Is Self Defeating  by Andrew Wilner, MD, FACP, FAAN Have you heard about locum tenens? Locums physicians act as "placeholders" in clinics and hospitals that need temporary help. Doctors may work locum tenens in addition to a regular job (moonlighting) or move from one assignment to another, traveling to different destinations and experiencing a variety of practice environments. If you've considered joining the approximately 50,000 locum tenens physicians in the US, here are five tips to get you started. 1. Why? Why work locum tenens? This decision depends on your stage of career. For example, newly graduated residents may travel to a part of the country they have never seen or experiment with different types of practices. Mid-career docs often need extra income or want to test the waters for a practice change. Pre-retirement physicians may wish to cut back a little, but their full-time job won't permit a part-time option. As a locum tenens physician, how often you work is up to you. 2. Find a good staffing agent. A staffing agent can offer invaluable assistance, particularly if this is your first foray into the world of locum tenens. When you chat with an agent, ask questions and communicate your needs. Agents focus on certain medical specialties, and it's their job to know the market. Agents work on commission, so there's no cost to you. Select a staffing agency that belongs to the National Association of Locum Tenens Organization (NALTO), which sets standards and sound business practices for locum tenens companies. Two NALTO members that I have contracted with are CompHealth and Staffcare. See the NALTO website for an updated list of NALTO staffing agencies. 3. Where and when? Decide where you want to travel and your timeframe. Once your agent knows where and when you wish to work, he or she will search for an appropriate opportunity that fits your schedule and offers the best compensation.

About the author: Andrew Wilner, MD, FACP, FAAN is the author of The Locum Life: A Physician's Guide to Locum Tenens Dr. Wilner can be reached at www.andrewwilner.com

By Eric Brown

USMLE Course Consultant After spending two years in the classroom, now it’s time to begin your third-year with clinical rotations. During clinical rotations, you get to immerse yourself in patient care, know more about the different specialties and put your bookish knowledge to good use. Although clinical rotation is exciting, this transition can be a stressful time. It may fill you with tons of anxiety. Therefore, it is important that you enter into clinical rotations with a growth mindset. They may seem daunting, but you get only one shot at it. So, make it count. With that said, here are 5 tips to succeed in clinical rotations. 1. Choose your rotations wisely Clinical rotations help medical students in figuring out what medical residencies are best for them. During the rotations, the students shadow physicians in variety of medical disciplines. This helps them in making an educated decision about what specialty they want to join and later practice. To choose the right clinical rotations that is aligned with your future plans is not easy. Some tips to choose the right clinical rotations:

4. Be attentive to what your patients are saying

Listen carefully. It is one important clinical skill that will help you be a better doctor. Each patient encounter will give you an opportunity to learn something new, if you pay close attention to what your patients are saying. 5. Be friends with your fourth-year peers A friend who is in the fourth year can be an excellent mentor to you. You’ll get invaluable advice from students who have been through what you are going through now. Talking with them will keep you informed and updated about the forthcoming challenge. 6. Ask questions You have got into the third year without much hands-on experience of examining real patients and dealing in logistics of the hospital. Now you are in the real world, seeing real patients; you’ve got a lot to learn. The only way you can learn better is by asking questions. Let no doubts remain in your mind; ask questions, however silly they may seem. While it may be perfectly alright to ask genuine questions, do not ask questions that could reflect poorly on you. Don’t ask questions that you can easily look up.

About the author:

Eric Brown is a standardized patient (SP) who lives in New York and advises NYCSPREP with their Clinical Skills course. He has a BA from a liberal arts college in the Northeast, where he majored in the theatrical arts and business (he credits the first for his ability to simulate real patients). He’s amassed years of experience as an SP and keeps up to date with CS exam expectations, trends and developments. When the Phillies are in town, Eric considers it his duty to support his home team. He won’t be seen without his trusty catcher’s mitt on these occasions, and prides himself on having caught more than one foul ball with it. If you have any questions about standardized CS exams or courses at NYCSPREP, email Eric at [email protected] or visit http://www.nycsprep.com. More advice from Eric Brown: How International Medical School Graduates Can Obtain US Clinical Experience

by Robert Priddy

Put another way, most markets have plenty of room for expansion and growth, and that includes you as a new entrant.

By Robert F. Priddy

About 15 years ago I wandered into my own career change moment when I began speaking with a physician at a local healthcare consultants networking meeting. I learned about his counseling service for physicians dissatisfied with the state of medical practice and recognized a need that demanded and deserved high caliber career transition and management services. That meeting resulted in a several years partnership and resulted in my third_Evolution in 2008. Since then, I’ve built on that base of understanding fostered both by my early physician partnerships as well as my 20-year career in hospital and consulting-based medical staff development and practice management.

What I’ve learned, you might say, is what I offer. Medical practice is a very demanding profession. Demanding, not just in the focus and the results, but demanding in the nearly single-minded attention to the daily activities of patient care. I speak with physicians every day who tell me they are open to nearly any job that uses their skills and knowledge and pays reasonably. And, as I usually reply, that’s not a job description, it’s a cry for help.

Effectively, asking other people to tell you what job they have for you or what job they believe would be good for you is a complete nonstarter. That why you, just like every patient you treat, need a focus… or a diagnosis, a Career Diagnosis™.

I conduct a formal, structured process with clients to construct a Career Diagnosis, but you can and should emulate that process if you’re going on this journey. I suggest a SOAP note format in order to follow a system that is both familiar and effective. Take your time… consider subjective elements like your interests and passions and then couple those items with more objective definitions of your skills and knowledge. As you build each of these three categories in lists – I suggest literally a three-column listing, you can then start connecting those words and phrases.

You see, most physicians, regardless of background simply don’t and won’t meet the job requirements or qualifications criteria of published jobs. So, as I say to my clients, let’s define the problems you want to solve and then find people or companies with those problems. This means applying for jobs only 10% or perhaps 20% of the time and networking for problem solving opportunities 80% or 90% of the time.

More advice by Robert Priddy- Self Protection is Self Defeating and The Resume Recruiters and HR People Hate Robert F. Priddy, President [email protected] 720-339-3585 voice 208-979-2134 fax

Most physicians come from a culture high on self-reliance. You may have belonged to a group practice, but you didn’t treat patients or perform surgery in a “group.” Medical practice is one patient at a by one physician at a time. It’s a pretty simple calculation. And anytime another physician is brought into a patient care situation it’s usually because that patient is being handed off… or taken away from you. Now you’re being asked to bring in another physician. Does this mean your job is being handed off… taken away from you? No, not if paragraph one accurately describes your work environment.

What this means is it is time to grow, to expand your span of influence and control. It’s time to offload some of your lesser tasks to someone else, and time to possibly acquire a slightly different skill set to open new opportunities – opportunities that will involve you if you allow them.

Shutting the door to staff expansion may appear to be self-protective, but you’re actually closing the door to growth, both intellectual and career. One of my adages when I was in the corporate world was that I could never have too many staff, have too much office space or too large a budget. In most corporate or organizational environments, the more your control, people, space and money, the more powerful you are and, and get this…, the more you have to give away if things get tight. Think about it, if you have a department of two and the corporate mantra becomes, we’re cutting back, you may soon be a department of one. Growth equals control, power, influence and viability. Don't shy away from adding that next physician, then the next and the next. There is safety in numbers.

More advice by Robert Priddy-The Resume Recruiters and HR People Hate, and Physician Career Change

If you’d like to strategize the new nonclinical job you have, one you hope to have or you’re just starting to test the nonclinical waters, call me, Robert F. Priddy, for a no charge, no hassle, hallway consult. Contact me at 720-339-3585 for voice or text or email [email protected]. You can also visit me anytime at http://www.thirdevo.com.

By Eric Brown

USMLE Course Consultant Every year a large number of physicians apply to pursue their residency in the United States of America. Each physician who plans to pursue residency in America has to learn about the intricacies of the American system in order to make a seamless transition from a foreign medical graduate to a successful practicing physician. If you are planning to pursue your residency in America, there are various aspects an International Medical Graduate has to consider while applying for clinical experience and residency programs in the U.S.

Which Students Are Considered as International Medical Graduates?

If you graduate from a medical school outside America, irrespective of whether you are a U.S citizen, you will be considered as an International Medical Graduate (IMG) when applying for residency programs. This will require you to take the USMLE and apply for clinical experience. But first, in order to take the USMLE and pursue your residency in U.S.A, being an IMG, you will first have to confirm that the medical school you graduate from is listed in the World Directory of Medical Schools. This is because medical schools listed in this directory meet the eligibility requirements set by the Educational Commission for Foreign Medical Graduates (ECFMG). Thereby, allowing you the register for the USMLE Step 1, Step 2 CK and Step 2 CS as an IMG.

Once you have cleared your USMLE exams, you then have to work on building your portfolio in order to secure admissions in a U.S. residency program. This will require you to obtain U.S clinical experience. Your clinical experience will be a part of your CV and other documents you will be required to submit when applying for a residency programs. The most common forms of clinical experience for IMGs are observerships, clinical rotations, clerkships or research positions. However, finding a clinical position in the US is not an easy feat, and being an IMG, your chances of securing a spot in a U.S residency program is much lower than that of a typical U.S. graduate. This generally happens due to the difference of medical laws and practicing patterns in various countries.

How Can IMGs Apply for U.S. Clinical Experience?

Being an IMG, finding the right type of clinical experience may be tough, but with the right methods, persistence and ingenuity, there are several ways to find the right type of opportunity, such as: 1. Use Renowned Online Resources The most trusted online resource when it comes to an all-encompassing database of medical schools, hospitals and clinics is a website sponsored by the Association of American Medical Colleges known as Extramural Electives Compendium. It is a free database lets you search institutions based on their geographic location. It also offers useful information about medical school campuses, application procedures, elective time, and fee structures of such institutions.

2. Go to Direct Placement Clinics

Since IMGs face such difficulties finding clinical experience, some clinics even offer clinical experience programs that you can attend by paying to participate. Such clinics even provide letters of recommendation in case of well-performing students. However, such direct placement clinics operate independently, be sure to ascertain whether they are certified by the American Medical Association, among other qualifications. Why is U.S. Clinical Experience Important for IMGs? Considering the highly competitive nature of this field, it has been observed that IMGs who participate in observer-ship programs to gain clinical experience are more likely to match. Many hospitals, research institutes, and private practices provide valuable opportunities to foreign graduates for internship, externship, volunteer-ship, and research assistance.

About the author:

Eric Brown is a standardized patient (SP) who lives in New York and advises NYCSPREP with their Clinical Skills course. He has a BA from a liberal arts college in the Northeast, where he majored in the theatrical arts and business (he credits the first for his ability to simulate real patients). He’s amassed years of experience as an SP and keeps up to date with CS exam expectations, trends and developments. When the Phillies are in town, Eric considers it his duty to support his home team. He won’t be seen without his trusty catcher’s mitt on these occasions, and prides himself on having caught more than one foul ball with it. If you have any questions about standardized CS exams or courses at NYCSPREP, email Eric at [email protected] or visit http://www.nycsprep.com/  By Dave Denniston CFA The world is changing. The concept of retirement is changing. Is an early retirement even possible? Heck, is retirement by 60 or 65 even possible? As a matter of fact, I’m seeing many folks work longer and longer- some even well into their 70’s. Truly, it’s not full time for the most part, but part time to scrape some extra dough for some of the extras that make retirement enjoyable- the hobbies, the travel, and the grandkiddos. In a previous post, I made a big leap and even suggested that Retirement is Dead. For newly minted attending physicians with student debt burdens over $300,000 and rising, a traditional retirement is getting further and further out of reach. My feeling is that we will be seeing more and more physicians experience what I am coining “The New Retirement.” Yes, I know that we currently have a physician shortage, but with more “cheaper” PAs and NPs gradually taking over the work for physicians in certain areas- we could see the landscape for physicians changing more and more. In this post, discover the three components of the New Retirement and how that may fit into your future plans. Component#1: House Debt Forces You To Work Longer What are we taught about buying our first place? What matters more than anything else? Location, location, and of course… location When it comes to the new retirement, location is everything and I’ll change those 3 words to: Home price, home price, and home price For many of us that are labeled gen x, gen y, and millennials- I see time and time again the impact of the price of your home on retirement. Consider a client in Southern California- they bought a fairly modest home for $900k. In comparison, here in the good ol’ Midwest, our place of similar size was worth around $250k around the same time. Can you imagine how much more quickly we’ll be out of mortgage debt and able to save more? Our friends on the coast are being FORCED to work much longer. Ironically, not only are costs higher- particularly homes…. but the salaries are also lower!!! This means that our physician friends on the coasts are likely to experience the new retirement- unless they do some creative investing or instead, force themselves to live like a resident for a big chunk of their careers. And it’s awfully hard to live like a resident and when you’re paying a resident’s salary for your home…

Component#3: Creating (or Acquiring) A Business Can’t find that passion for medicine again? Are you eager to try something else? For some of us… maybe you don’t want to start from scratch and you don’t want to work ‘for the man’. Wouldn’t it be great to have a business that you can get cash from immediately? Check out what I did by buying an existing business. I’m not going to lie. It’s not all rainbows and sunshine, BUT if you structure the acquisition right- you can protect yourself and your future while creating multiple streams of income. As a matter of fact, I like it so much- I am planning on acquiring or starting 1 new business every year the next 2 to 3 years. This should allow us to generate a few thousand extra dollars a month. As we develop more systems and automation, each business should be on autopilot with some course correction from time-to-time. Final Thoughts Doctors like you are the best and brightest that our country has to offer. As you may explore the “New Retirement”, keep an open mind. You have the capacity and ability to contribute so much to the world- whether you are treating patients or starting a new business. Keep trying, keep testing, and above all else, keep pursuing the financial freedom you so richly deserve. More Advice by Dave Denniston- Does Stuff Own You? and Finances of Business vs. Hobby About the Author

Dave Denniston, Chartered Financial Analyst (CFA), is an author and authority for physicians providing a voice and an advocate for all of the financial issues that doctors deal with. He also has 1 wife, 2 kids, and a bunny named Black Snow (which is a lot better of a name than Yellow Snow). If you’ve enjoyed this guest post, you can learn more about his adventures in financial planning, liquid investments, illiquid investments, & much more nonsense by finding his latest blog post and videos *Several of the links in this article have listed 3rd party firm/individual are not affiliated with or employees of United Planners Financial Services. United Planners does not supervise this firm/individual and take no responsibility to monitor the information/services they provide to you. The opinions expressed are those of Dave Denniston and The Capital Advisory Group and are subject to change based on market, tax, and other conditions. The information provided is general in nature. Consult your investment professional regarding your unique situation. Securities offered through United Planners Financial Services 800-966-8737, Member FINRA, SIPC. Advisory Services offered through Capital Advisory Group Advisory Services, LLC. 5270 W. 84th Street, Suite 310, Bloomington, MN 55437, 952-831-8243, United Planners and Capital Advisory Group Advisory Services LLC are not affiliated.  By Bishoy Gad MD, MS, MBA After spending the 4 years in medical school, and then additional time in residency and often fellowships, most trainees feel appropriately trained to practice medicine. The challenge is that very little time in a resident’s education is devoted to some of the most important aspects of this profession; finding a job that is the best fit and developing the foundation for a strong practice for the future. In some specialties, 70-80% of newly hired physicians change jobs within their first two years of practice[1]. The majority of mentors to young physicians are academics who have not changed jobs for many years. However, a large portion of physicians in the United States are in private practice[2] Practice types There are a variety of practice models available for potential employment opportunities. They can essentially be broken down into three major groups: private practice, hospital employment, and academic medicine. There are other practice types and hybrids of these types, but for simplicity we will discuss these major practice types. *Private Practice There are a variety of ways to be in private practice; either as a solo practitioner, a member of a single specialty group or a member of a multispecialty group. Solo practitioners essentially function on their own and manage their own billing and collections. These physicians must have a good understanding of their market, ancillary sources of income, staffing, and efficiency to survive[3]. A single specialty group is typically a group of specialists who may hire adjuncts that complement their practice. There are many benefits of being a member of these groups. There are economies of scale, increased leverage in dealing with hospitals and insurance companies, and can be powerful academically[4]. Being a member of a single specialty group gives the physician an opportunity to make additional income from ancillary sources such as imaging, durable medical equipment, ownership of a surgery center, ownership of physical or occupational therapy, and so on. Typically there is equity involved and the shares should be purchased if the practitioner is interested in partnership and ancillary sources of income. Purchasing of equity is commonly known as a buy in. The buy in can often be multifaceted depending on what assets are purchased. Multispecialty groups are typically larger groups comprised of general practitioners such as family medicine doctors and internal medicine doctors. These groups often will hire specialists to capture some patients that are being referred out of the group for common services. There may or may not be equity involved in employment. Often there are also ancillary sources of income, however these sources are divided among a larger number of individuals. Being a member of such a group does have benefits for specialists including an automatic referral base that will assist in starting a practice. Many private practice groups will offer a stipend for the first few years of practice until the physician is able to sustain himself or herself on the revenue produced by their practice. Some groups offer this as a stipend payment, and others will offer it as a loan. It is imperative to understand the basics of finance and how these particular practices collect in order to avoid unnecessary losses. This includes having discussions with the practice manager and/or collection agents and the group prior to joining. The benefit of this practice type is the high income potential as the practice develops, in addition to being able to use the practice and many practice related purchases as business expenses- such as a car, cell phone, computer, and educational expenses. *Hospital Employment The second major type of practice is hospital employment. Typically, but not always, a new physician is given a salary and potentially a bonus. Given that hospitals are often non-profit or not-for-profit organizations, they are required to see a certain amount of patients who are either uninsured or cannot pay. Often physicians who work in this setting are measured by work relative value units (wRVUs). Medicare assigns wRVUs they will give credit per office visit, hospital visit or procedure. For example in 2015 the number of wRVUs for a level 4 new patient outpatient encounter was 3.17[5]. Typically physicians are paid a multiple of the number of wRVUs they produce. That multiple is typically determined contractually and usually varies by specialty. Often, a set number of wRVUs is expected to be hit by the physician annually. After this threshold is hit, the physician, depending on the structure of his or her contract, may be eligible for a bonus based on production. A recent Merritt Hawkins survey found that 74% of physician search assignments offered a bonus with 52% of those being based on wRVUs[6]. The benefit of this practice type is that the doctor is not responsible for managing overhead and other employees. Typically these jobs will pay more than private practice stipends will initially. However, long term these jobs from an income standpoint typically will not pay as much as practice jobs because there is no access to ancillary income. In addition, be aware of the leadership of these hospital systems. Nine of the top 10 most economically efficient and clinically effective hospital systems were owned by physicians[7]. *Academic Practice The third major practice type is that of an academic doctor. Many of these opportunities are functionally hospital-employed physicians, and while there may also be a threshold for production as in standard hospital employed positions, an emphasis on other metrics is often placed. For example, additional payment may be tied to education of medical students or residents. There may be additional compensation for academic tenure or productivity in research. The benefit of this type of work is often the flexibility of schedule in order to be able to engage in non-clinical activities. *Other There are still other practice types as well. Those include employment by a health maintenance organizations (HMOs), locum tenens positions, military employment, and administration[8]. Of course there are a variety of practices that do not fit in these clean categories. Many single specialty surgery groups are large enough where they have affiliations with academic centers and do place value on education and research, but also have an interest in production as well as opportunities for obtaining ancillary income. It is important to have a very good understanding of what the practice goals are prior to joining the group. Malpractice considerations There are two major types of malpractice insurance: claims-made and occurrence-made[9]. Claims-made insurance is the less expensive form of insurance that many groups and practices may offer. Essentially, in order to be covered, the physician must carry the insurance policy both when the claim is made and when the event occurred. For example if a new internist works for a practice in the month of July and performs a lumbar puncture for meningitis, quits the job in August losing her claims-made insurance, and gets sued in September, she is not covered for that claim. At this point she is essentially putting her assets at risk. It would be prudent for the doctor to obtain additional insurance coverage where the prior claims-made insurance policy lapsed. This additional coverage is known as tail coverage[10]. The cost of tail coverage often is 150% to 300% of the cost of an annual claims-made malpractice insurance policy and can be over $100,000[10] for some specialists. The new employer may also purchase nose coverage which covers incidents that occurred before the beginning of employment for which a claim has not yet been made[10]. Occurrence-made insurance is more expensive than claims-made insurance. Often, many larger systems will carry this insurance because they are self-insured. Occurrence-made insurance implies that if the physician carries this particular type of insurance at the time the event occurred regardless of when the claim is made the physician is covered by this insurance. Returning to the previous example the physician performs a lumbar puncture in July, leaves her job in August, and gets sued in September. She is covered by her prior employers’ malpractice insurance. There are other considerations when evaluating malpractice. Some institutions have a policy of trying to remove named individuals in a lawsuit and essentially will have the lawsuit placed against the institution. This has obvious benefits, as lawsuits and settlements are reportable to the national provider database (NPDB). In addition, the state of practice has a large bearing on malpractice. States with tort reform often have lower malpractice rates than others. All these are important considerations when evaluating job opportunities. Market considerations It is important to be mindful of location when looking at employment opportunities. Planning on an exclusive colonoscopy practice in New York City is not a novel concept. Depending on the saturation of a region, the services of a subspecialty may be commoditized to a degree and will be reflected in a physician’s salary and benefits package. Opportunities may be different in different areas of the country at different times. Retirements and relocations of other doctors as the particular skill set of the new physician may affect the availability of positions and potentially the quality of the contract that can be obtained. If there is a great need for a particular type of service in a particular area, compensation and benefits packages tend to be more lucrative.

Tips on negotiating Probably the most important thing to realize is that if something is not explicitly written in the contract, it will not happen. The concept of a handshake or verbal promise does not hold the same weight it did in prior generations. The practice manager handling the contract negotiation may be fired the day after a new physician signs his or her contract, thereby nullifying any verbal promises made previously. Negotiating the terms of the contract can be extremely uncomfortable, especially if it is with people the prospective employee may view as a mentor. Hiring an attorney to review the contract or an intermediary/negotiator to help with the terms of a contract may be beneficial [8, 11]. It is critically important that the details of the contract and the details of the employment opportunity are outlined explicitly prior to signing any contract.

Determining value There are many definitions to value. From a compensation standpoint, a variety of sources report medians for a physician’s income. Some of those include the Medical Group Management Association (MGMA) the American Medical Group Association (AMGA), and many recruitment firms. For example, according to the compensation 2013 publication by the AMGA the median pay per wRVU for an internal medicine physician was $47.47[13]. Depending on the practice type this number can vary. Practices that are based on collections are not necessarily concerned with wRVUs. Academic practices may offer payment based on academic appointments. Payment also varies by region as well as population density. More rural areas tend to offer larger salaries for hospital employed physicians due to their challenges with recruitment. However that does not mean that a physician cannot earn more being employed in a large city, It might just be more difficult to find. Even if a doctor finds a job that is willing to pay two million dollars per year, the terms of employment and the people the physician will work with are also of great importance. Understanding value will give the physician confidence in his or her negotiation. It is important to have a plan on which terms of the contract are negotiable, and which terms are not. If an impasse is reached or the employer or partners are unwilling to negotiate on certain terms that are of critical importance, an option may be to politely walk away. Partnership and employee morale Discussion of contracts, compensation, and markets are important, but an item that should not be neglected is the overall picture of the practice and the relationship between partners and/or fellow employees at a workplace. Everyone has different tolerances for different types of environments. Some thrive in very high stress, high pressure environments, and find it thrilling. Others thrive in more relaxed environments. It is important that the physician understands himself or herself in order to select the proper practice that fits their personality well. It is important to talk to and meet as many people as possible to determine the overall morale of a practice or employment opportunity. The search for employment is one of the few times a surgeon may yield significant power. It is important to be thorough in an employment search and honest about expectations of specific contract terms. The contract negotiation period is the time that will determine the foundation of the future practice. Understanding the basics of business and contracts is critical to creating a job opportunity that is right for you. The intention of this article is not to be a step-by-step guide on how to find the right job. However it is an introduction to basic concepts that will assist in making a more informed decision. This article is not a substitute for a mediator or an individual experienced at reading terms in a contract and also no substitute for an attorney reviewing the language of the contract. Bishoy Gad, MD, MS, MBA is a board-eligible Orthopaedic Surgeon currently at New England Baptist Hospital for an adult reconstruction fellowship who trained at the Cleveland Clinic for residency. He has a special interest in healthcare process and delivery improvement. He currently serves as the chair of the practice management committee for the American Academy of Orthopaedic Surgeons' Resident Assembly. References

1. Dyrda, L. 25 Key Concepts for Young Orthopedic & Spine Surgeons to Build a Successful Practice. 2012; Available from: http://www.beckersspine.com/spine/item/11832-25-key-concepts-for-young-orthopedic-spine-surgeons-to-build-a-successful-practice.html. 2. Orthopaedic Practice in the US 2014, in AAOS, A.D.o.R.a.S. Affairs, Editor. 2015: Chicago. 3. Soyer, A. The solo practice: Strategies for success. AAOS Now, 2010. 4. Collon, D. Super Groups: Are They the Future of Private Practice? AAOS Now, 2013. 5. Coberly, S. Relative Value Units. 2015. 6. RVU BASED PHYSICIAN COMPENSATION AND PRODUCTIVITY: Ten Recommendations for Determining Physician Compensation/Productivity Through Relative Value Units. 2011. 7. Heiney, J.P., An examination and discussion of unintended consequences of being an employed physician. J Orthop Trauma, 2013. 27 Suppl 1: p. S17-21. 8. Henley, M.B., Finding your ideal job and negotiating your contract: where to get the information and numbers you need to know. J Orthop Trauma, 2012. 26 Suppl 1: p. S9-S13. 9. Malpractice Insurance. 2016. 10. Fleeter, T. The Hidden Cost of “Tail” Insurance. AAOS Now, 2012. 11. Harolds, J., Tips for a physician in getting the right job, part XIX: introduction to employment contracts. Clin Nucl Med, 2015. 40(2): p. 128-30. 12. Porter, M.E., What is value in health care? N Engl J Med, 2010. 363(26): p. 2477-81. 13. Vaudrey, B.S.a.L., Sara, Compensation 2013: Evolving Models, Emerging Approaches: Results from the AMGA 2013 Medical Group Compensation and Financial Survey American Medical Group Association, 2013.

When should physicians seek career advice? By Alexis R Small, Physician Career Agent

“The Medscape Physician Lifestyle Report, says that 46% of all physicians responded that they had burnout, which is a substantial increase since the Medscape 2013 Lifestyle Report, in which burnout was reported in slightly under 40% of respondents. Burnout is commonly defined as loss of enthusiasm for work, feelings of cynicism, and a low sense of personal accomplishment.” (Medscape.com – January 26, 2015)

Physicians labor through 4 years of medical school acquiring 6-figure debt. Then, they fight through 4 more years of residency with little to no sleep. Finally, they start a much-anticipated career in medicine, only to constantly worry about how they are going to pay back that 6-figure debt in this current healthcare environment that offers less freedom to practice medicine. Or, after all the time and money they’ve invested, some come to the realization that a career in clinical medicine is not for them. At what point during those 8 years of medical training do physicians receive any guidance related to career development and planning? One option is the Careers in Medicine website offered by the Association of American Medical Colleges.

But, what do you do if you are several years into your medical career before you come to the conclusion that clinical practice or medicine, in general, is not the career for you? Who’s going to help you navigate the winding highways of career options available to you at this stage in your career or decide which way to travel at the crossroads of your career journey? Are you even comfortable seeking the advice of a career professional? I mean, you’re a physician, deemed a member of one of the most intelligent professional groups, as well as one of the most sought after professionals in the world. Why would you even need any career advice? You can figure this out on your own, right? You make 6 figures or more on an annual basis. You own your own practice or you work for one of the most highly accredited institutions in the country. You diagnose chronic diseases and treat complex illnesses. Surely you can figure out this career thing!

Dear Physician, If you struggle to get out of bed in the morning to go to work and have decided that it is time to make a change, you might want to seek some career advice.

If you know that you want to pursue a different career, but have no clue where to start, you should seek some career advice. If you know that you want to change jobs, but don’t have the time to look for available openings, then you should consider seeking career advice. If you love medicine, but hate clinical practice, you should seek some career advice to help you research your career options. If you enjoy your job, but can no longer stand the people you work with or the environment you work in, you might want to seek some career advice. If you are in private practice, but have become exhausted by all the red tape, then maybe you ought to consider getting some career advice.

If any of these reasons or scenarios apply to you, then you should consider reaching out to a career professional who: *Has experience working with physicians *Enjoys helping physicians find the best career/job fit *Understands the healthcare landscape *Is adept at navigating the recruiting/hiring process *Has your best career interest in mind This career professional could be a Career Advisor, a Physician Recruiter or an Executive Coach. Take your pick. Just make sure you get the help or advice you need to move forward in your career. The options are endless!

Contact Alexis Small by email at [email protected] or by phone at 704-975-0844

by Sameer Islam MD As a new doctor, I soon got overwhelmed by all the things that came up in my day: patient questions, messages from my electronic health record, labs results, staff queries, etc. It seemed like as soon as I got one thing done, another pile of stuff came crashing down on me. And this didn’t even include seeing patients, running a clinical practice, doing procedures or having a family life. I was allowing the priorities of something else take over and in return my personal life and well-being suffered. I knew that something had to be done or I would go insane. So I started to look into different productivity ideas from the business world to help me out, and I found one that changed my outlook: batch processing WHAT IS BATCH PROCESSING? Batch processing is the idea of grouping similar tasks requiring similar resources in order to streamline their completion. You ONLY do these tasks during the allotted time and no other tasks are performed. There is little change in cognition while doing these items - they take up the same mental bandwidth. Studies have shown it can take up to an average of 15 minutes to completely regain focus, and by multi-tasking we can lose up to 40% of our productivity. In fact, working in a perpetual state of shifting tasks and refocusing attention creates fatigue, stress, and decreased productivity. If that’s the case, we are not being nearly as effective as we could be and we are not giving ourselves or our patients our full attention. I have personally experienced this when I am deep in the middle of a task, and then an email pops up and I get distracted with the email. As soon as I am done with the email, it takes me a while to remember my previous task and even longer to get back into the flow of things. Once I get going, someone will interrupt me about a non-urgent issue. I address that, but the cycle of unproductivity continues. That is wasted time that ends up eating my day. HOW DO I CHANGE? So now that I knew what to do, the question in my mind was HOW can I do this. It took some trial and error, but I think I got my system down. I use my calendar as the guidepost for batch processing. I also made a list of what I need to get done to make sure I cover all my bases. This is important because there is a huge difference between need and want. There a lot of things I want to do but very few I need to do. I had to think hard about what really was necessary. My list is comprised of:

What I did: 1130-1230: “Patient Stuff”. Every day I blocked out this time to review patient labs/imaging and contact the appropriate staff. I only worked on this and I made sure to finish within the allotted time. I turned off my email, closed my other internet browsers, turned my phone to silent, and closed my door. 430-500: “Review.” Here I reviewed any pre-authorizations from my staff, delegate tasks, cover any emergencies or overflow from before. Same process as above. Weekly Review: Also, once a week I did a “weekly review” to assess what was coming up next week and to capture anything I might have missed from the week before (more on this later). After experimenting on this for a while, what I found was:

What do you think? What have you done to make your time easier? By Sanjana Vig MD I made the decision to get an MD/MBA when I was still in high school. I had an interest in medicine but I hated the idea of being yet another Indian doctor. How unoriginal. So when my dad introduced me to someone who had done this dual degree, it was my “aha!” moment. As far as I knew, this was something different, could set me apart and no one else I knew was doing it. Perfect!

Now, we are paying the price. Literally. We dance to the tune that managers play for us, not quite understanding why certain things are done or why certain policies exist. On more than one occasion, I have heard, or even myself have asked: “why do I have to fill out this form” or “there has to be a better way”, or “I know a better way!” Hospitals are, at its most basic form, a business. Yet we are never taught about even the most basic business components, let alone how to run one. We have no exposure to accounting and financial topics; we passively gain teamwork and team building experience during residency, but there are also business leadership concepts and communication strategies that we do not learn. Healthcare is dynamic and constantly changing. With the Affordable Care Act and whatever congress is trying to accomplish now, changes are happening, and will be coming, that directly affect how hospitals are managed, how insurance is handled and ultimately how we get paid. There is clearly a gap between physicians and managers, not just in communication, but in understanding as well, and it needs to be bridged. Doing so requires physician leadership that can be present at the table, engage in administrative discussions, assist in formulating business decisions and be a voice for clinicians. Why an MBA? Much of the push back I got as a student was, sadly, from other students. I was regarded as a sell out for wanting another degree, because, apparently, this meant I wasn’t serious about medicine. In addition to that accusation, I was questioned for not getting and MPH (Masters in Public Health) or MHA (Masters in Healthcare Administration), as those degrees were seen as being more in-line with a medical career. My response: I wanted a broad understanding of business and finance. In my mind, while those degrees are certainly helpful, they would not help me achieve my goal. I wanted to understand all business, not just healthcare. I wanted all related business topics on my plate, not just public health issues. I wanted to understand consumers as a whole, not just hospital and clinic patient populations. I wanted to understand money making from the perspective of any business, not just medicine. For me, personally, an MBA means I can work in any hospital, any clinic, or any government or private sector healthcare organization, and I wanted those options. Benefits of a dual degree A 2011 study by Dr. Amanda Goodall examined the top 100 hospitals, as determined by US News and World Report, and compared their CEO’s. Those with physician based leadership scored 25% higher in hospital quality measurements. While there’s no direct causal relationship identified here, there is support for the idea that leadership without clinical expertise can lead to inferior management abilities in the hospital setting. Plus, a physician leader has instant credibility with both clinicians and managers, making it easier to bridge that gap between both parties. Managers are more likely to trust someone with some business acumen and physicians are more likely to trust someone who understands the daily clinical issues they face. Having a physician be a part of administrative discussions also helps protect other physicians and related clinical interests. On a more personal note, the additional degree can serve as a point of leverage to advance career goals and move up the managerial chain much faster than would otherwise be possible. If moving up the chain isn’t part of your goal, then just having the knowledge, period, can help you develop a better understanding of why certain decisions are made and at the very least, help you converse intelligently with administrators in a way that is effective and productive. In todays’ climate, where hiring mid level providers is seen as more cost effective and MD’s are too expensive, giving yourself another skill set will make you irreplaceable and even desirable. While a second degree, or a career in leadership, is not for everyone, I believe that physicians owe it to themselves to take back control of their careers. Even without a degree, you can be proactive about paying attention to the business aspects of your jobs, asking questions, obtaining information and empowering yourself with business knowledge so that you don’t get left behind. Be a boss. (You already are one) --YouBeThree  And Why It Should Be The Resume You Use by Robert F. Priddy By its definition, a functional resume serves three purposes.

Recruiters and HR people hate functional resumes because they can make it harder for them to understand your current job title, because your years of experience may not be obvious, because specific jobs and specific duties probably aren’t linked and, well, just because they don't offer an easy to understand chronological check list of your past. If you are a candidate who perfectly fits the career climbing ladder - one who has the requisite three to five or five to seven years of experience as defined by your job titles, and specific responsibilities coupled with an easily measured and tracked rise in title and responsibility, then, a chronologically arranged resume, as most recruiters and HR people prefer, is right for you. It shouts to the recruiter or HR person, “Look at this! I match your requirements and expectations perfectly! Look at me! And, they probably will.

This is why (and this is very important) I consistently advise my clients to never, never apply for a posted job and to never expect a recruiter or HR person to embrace them as a viable candidate unless their first interaction is a verbal one based on addressing specific job/organizational problems and a need for intervention they can specifically provide. Here is a simple test. Would you be terminated by your employer if you were an excellent clinician or surgeon, but failed in all your administrative duties? Usually, let me stress usually, the answer to that question would be no. Sure, you may be replaced on the QA committee, but you would not be terminated from the organization. And that’s the answer most recruiters and HR people would expect. When they see the practicing physician who has had some administrative responsibilities, they immediately assume administration is a secondary or even tertiary responsibility for which little accountability has been expected. The functional resume is not intended to address a specific job, rather it is intended to represent you. You might even consider it an expansive business card. Since your business card lists your Core Competencies, your functional resume just expands on those, and adds some additional qualifying information.

If by contrast, you simply handed the recruiter your CV or resume that follows a chronological CV-type layout, the recruiter sees a practicing physician who may have some administrative responsibilities. They don’t see someone whose primary responsibilities have held them accountable to administrative results. Back to the functional resume. Its objective is to dispel that perspective and to present you as a leader or executive who happens to carry a medical degree. And, after all, that’s the person you want to be seen as – right? More advice by Robert Priddy- Self Protection is Self Defeating and Physician Career Change Have you ever wondered… Am I spending too much? Will I ever be able to retire? As a matter of fact, I think we can sum it up in a few short words in the form of a question… Does ‘stuff’ own you? You may own ‘stuff’ legally. However, emotionally I see many physicians owned by their ‘stuff’ rather than the other way around. What do I mean by that? Let’s explore 3 signs that you may be owned by your ‘stuff’. Sign# 1: You have high amount of monthly obligations As I look at different physicians that I’ve worked with over the years, they fall into two different camps: there are savers and there are spenders (and of course many of us lie in-between). Check out the best 12 pieces of advice that I could possibly give to either of these groups. The spender physicians are some of the kindest, most wonderful people. They are giving and they are dreamers. They take amazing trips and vacations. They work super hard and play hard. They are also often burdened with a whole bunch of monthly payments. Here are some common examples:

If this resonates with you, here are some immediate actions that you can take to improve your situation:

Sign# 2: You are working a tremendous amount of hours to support your lifestyle Due to all of these obligations, there’s this crushing pressure to perform financially. I’ve seen many of these wonderful people taking on locums opportunities in order to stay ahead. Many of them are working a full-time gig plus locums on the side. They are working more than 80 hours per week and they wonder if they can keep up the pace. As a matter of fact, they are on the fast track to burnout. How can they possibly get off the hamster wheel where they are racing, racing, and racing and never able to get off? Here are some guidelines that may be helpful:

Sign# 3: An early retirement is out of the question Another way to track “does your stuff own you” is by examining if an early retirement may be out of the question. You may be wondering- how do I know if that’s even a possibility? If we go back to our earlier exercise of tracking personal expenses, a simple run of thumb to find out if you can retire today is to…

Here’s another slightly more complex set of rules of thumb to track your progress if you have a significant amount of time away from ‘your number’.

If we look at my situation, we’re averaging $4k/month savings. I’ve got about 14 years (168 months) until target retirement. That’s a total savings of about $672k (with no growth). Our total assets minus liabilities are around $1 million. So, we’re currently quite shy of that goal! 55 might be more realistic for us based on our current savings habits based on these rules of thumb. Keep in mind these are just a couple of simple exercises. Financial planning is significantly more complicated when you take into consideration inflation, growth rates, salaries, taxes, etc. As you do a little bit of math and if retiring by 45 or 50 or 55 is completely out of the question- I suggest that it’s time for us to take a long look in the mirror and re-examining our habits. Did you realize the impact that some small tweaks could have financially? It’s all about putting yourself in the position to succeed.

More Advice by Dave Denniston- The New Retirement and Finances of Business vs. Hobby About the Author

Dave Denniston, Chartered Financial Analyst (CFA), is an author and authority for physicians providing a voice and an advocate for all of the financial issues that doctors deal with. He also has 1 wife, 2 kids, and a bunny named Black Snow (which is a lot better of a name than Yellow Snow). If you’ve enjoyed this guest post, you can learn more about his adventures in financial planning, liquid investments, illiquid investments, & much more nonsense by finding his latest blog post and videos The opinions expressed are those of Dave Denniston and The Capital Advisory Group and are subject to change based on market, tax, and other conditions. The information provided is general in nature. Consult your investment professional regarding your unique situation. Securities offered through United Planners Financial Services 800-966-8737, Member FINRA, SIPC. Advisory Services offered through Capital Advisory Group Advisory Services, LLC. 5270 W. 84th Street, Suite 310, Bloomington, MN 55437, 952-831-8243, United Planners and Capital Advisory Group Advisory Services LLC are not affiliated.  By Sabine Fonderson MD I have asked myself many times why some people wait till the moment before the break of dawn to have their most pressing issues resolved in the emergency department. A 52-year-old male had come in by ambulance with difficulties breathing. The paramedic had also noted that, ‘the patient is known to have asthma and is on inhalers. All observations are fine’. Yes, I admit there are also many times I wonder why paramedics decide to bring non-emergency cases to the emergency department for “assessment”. What more can be assessed if someone is fine? When I ushered the patient into the cubicle I remembered how he gestured to his wife not to come in with him. But she ignored it and just walked right in. ‘What can I do for you?’ I asked the husband as he sat down on the chair. ‘I was having difficulties breathing tonight’ ‘Yes, I read the ambulance triage sheet. How do you feel now?’ ‘Better, I am not having breathing difficulties anymore. But doctor, can you please tell me why I am feeling this way?’ ‘I do not know.’ I replied and thought to myself, if he had any sense, he would have thanked me and apologized for wasting everyone’s time and left the department. But instead he sat there, staring at the floor as if he would find the answers to the breathing difficulties he no longer had and where they came from. I rolled my eyes. Yes! I rolled them way up to the ceiling and back at him again because he was not even looking at me, and neither was his wife. She sat practically facing the door, ready to leap out. I proceeded with more questions. The more I asked open ended question the longer it would take for him to give me a straight response, so I quickly reverted to questions that required a simple ‘yes’ or ‘no’ answer. It took me almost 6 minutes to get to the simple conclusion that he smoked despite his asthmatic condition. I felt the need to explain the effects of smoking. As I proceeded to elaborate on how smoking can exacerbate an asthma attack, he felt the need to remain silent, and, to my amazement, he had fallen asleep. ‘Why are you sleeping? Am I boring you’ I said in a raised tone. Even his wife startled and turned towards him. ‘Oh, sorry doctor. You see I have not slept in days.’ ‘Yes, doctor, that is true,’ His wife confirmed. Speaking of sleep, I was so desperate to get out of the department and get some of it myself. ‘Why have you not been sleeping then?’ I was getting quite agitated at this point because that is not the main reason he was brought to the department and now he was forcing me to dig deeper into issues that, frankly, I could not care about, especially not when I had 5 minutes remaining till the end of my night shift from hell. ‘It is my wife….’ Long pause. Very long pause. ‘She is having an affair’ Well, I sure as hell did not see that coming. Daytime soap opera in the emergency department. Soon a bickering match between husband and wife ensued. To my amazement, he had found his voice and started relaying all the events that led to the affair. He depicted in detail how when he was in the basement he could here her with her lover making love in the bed he brought. Her lover was a nobody in India, and since he had lost his shop she had made it very clear how she despised him. She would not even look at him, and that is why he found himself hiding away in the basement, abandoned by his own wife. The shame he had felt was incredible. He could not talk to family and friends about this because he would be laughed at. He had already lost his shop and now his wife was having an affair with a poor boy from India. She turned on him, repeating and confirming everything he said and looked at me as if I would take her side. I just sat there and listened as both husband and wife conversed with each other. I think something good did come out of this. There was some form of communication established between the two and for that second they must have felt like a married couple again. And I unintentionally became a marriage counselor About the Author

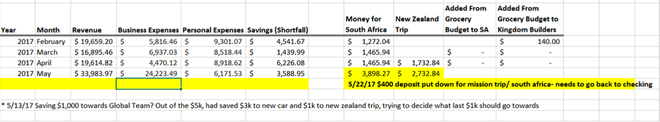

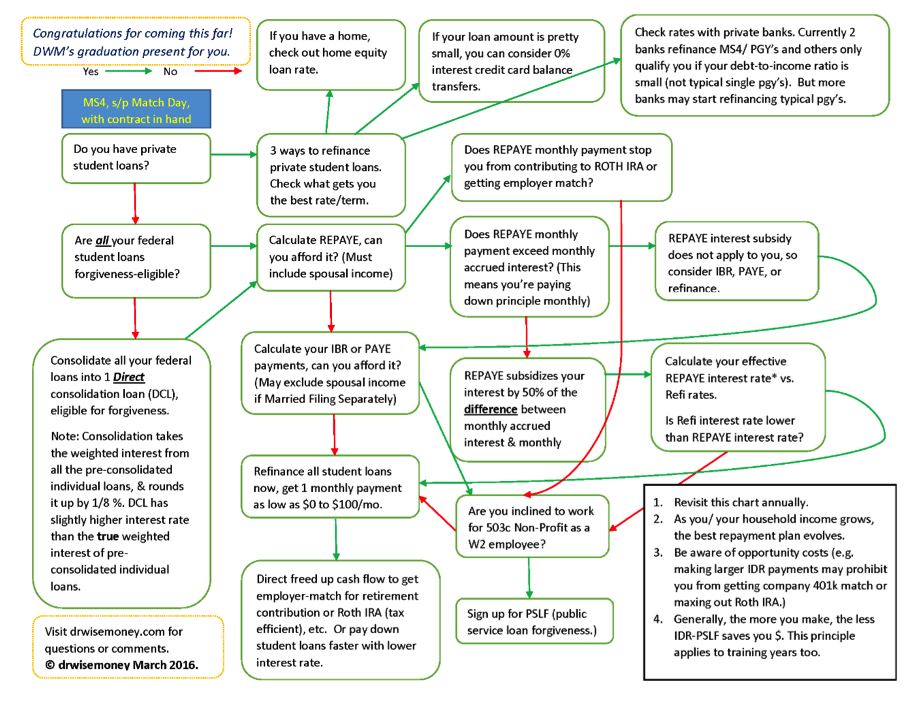

Sabine Fonderson MD is an emergency medicine doctor in Scotland. She is passionate about writing and is a freelance editor and content author for blogs and medical startups. Sabine is author of Unbelievable stories from the emergency department, published in May 2016. She writes about her experiences as an ER doctor on her website www.sabinefonderson.com There you can also read how she has found creativity and flexibility in her professional life. Student Loan Management: Refinance Student Loans or Public Service Loan Forgiveness with Income Driven Repayment Plans by Amanda Liu DO Not only has average educational debt grown drastically more cumbersome over the past decade, but decisions on how to manage one’s student loans have also become much more complex. For the 2016 class of graduating medical students, there are 4 federal income driven repyament (IDR) plans: ICR (Income Contingent Repayment), IBR (Income Based Repayment), PAYE (Pay as You Earn) and REPAYE (Reviwed Pay as You Earn), in addition to standard, graduated, extended repayment plans. Adding further complexity, for the first time in early 2015, residents and fellows are given the opportunity to refinance their federal and private student loans with 2 private banks: LinkCapital (currently out of funds to lend) and DRB. Upon becoming an attending, many more banks are willing to refinance doctors with large debt as well as high income. Here’s a flow chart which summarizes the most beneficial repayment options for a typical post-graduate trainee with high debt-to-income ratio (50-70k income; 200k student debt). These options include IBR, PAYE, REPAYE, & refinancing student loans. Student Loan Management for 4th Year Medical School Students & Post Graduate Trainees (Residents and Fellows) Once you’ve decided to refinance your student loans, rather than going for income-driven-repayment & Public Service Loan Forgiveness, it is critical but challenging to shop for the best interest rate and term. One way to start shopping around includes asking friends for recommendations and applying to multiple banks simultaneously. When you apply to multiple banks within a short period of time, these inquiries will only count as one ding to your credit score. It is understood that you are simply shopping around for a big-ticket item such as student loan refinancing and or home mortgage. I have been paying very close attention to the interest rates and terms that banks are offering for student loan refinancing and this is what my research has shown me. A friend of mine from Touro University in California who is now a practicing pharmacist refinanced her student loans with to a 15-year fixed 3.5% interest rate loan (she refinanced before the feds adjusted the prime rate up by 0.25%; the current 15 year fixed is 3.75%.) She is happy that not only is her interest rate ½ of what she was paying before refinancing her federal student loans, but also the long 15 year term allows her to reserve more cash flow (than a shorter term loan) for retirement savings and down payment for buying a home in California. I am happy to see that there’s finally a break for the medical professionals, especially those living in high cost of living areas such as many cities in California. So I reached out to First Republic Bank, and after several weeks, I heard back from Kerry Berchtold, Relationship Manager at FRB. FRB Rates (March 2016):

*The lowest 5 year fixed rate with CommonBond, DRB, Creidble, or Sofi right now is 3.5%. If you qualify to refinance your student loans with FRB, you get the ONE published rate and term, not an interest rate somewhere in the range of rates offered by most other refinancing banks. For example, my friend with 800+ FICO score refinanced with DRB and got 5.65% interest rate (which initially surprised me as it was at the high end of the advertised range of interest rates for 10 year fixed loan). DRB explained that he didn’t get the low end of the range because his debt/income ratio was high, which is true of most typical PGY's with 200k+ debt and 50-75k in While DRB was the best option for him as a PGY4 (he would not have qualified with FRB due to geographic requirement and debt-to-income ratio requirements by FRB), I definitely encourage him to refinance again, when he becomes an attending. To qualify:

#1: It all hinges on debt-to-income ratio, which differs by individual circumstances. In general, attending physicians can qualify; tougher for PGY’s to qualify but never hurts to find out. #2: You have to live or work in locations FRB have banking branches, which include: California, specifically San Francisco, Palo Alto, Newport Beach, Palm Desert, Los Angeles, San Diego, and Santa Barbara New York, NY Boston, MA Portland, OR Palm Beach, FL Greenwich, CT #3: You Forego Potential Forgiveness such as PSLF like refinancing with other private banks. This loan is a personal, unsecured loan with all that entails. It doesn’t go away if you die (and will be assessed against your estate.) It goes away in bankruptcy. There are no provisions made for unemployment, underemployment, death, or disability. So be sure you have enough life and disability insurance to cover the amount borrowed. #4: $60k-$300k Range: FRB won’t refinance loan amounts lower or higher than this range. If you have 300k+ in student loans, refinance 300k with them to get the lowest rate/best term, and then refinance the excess portion with another bank. If you have less than 60k in student loans, you are in pretty good shape. You can still refinance with other banks like DRB, common bond, Linkcapital, Earnest, etc. Dr. Wise Money (DWM) is a 1st year resident (PGY2) in the Department of Medical Imaging at Banner University Medical Center. As DWM achieves her financial goals of purchasing a home (MS4), paying off student loans (PGY1), & maxing out retirement savings (starting PGY2), she begins writing and giving talks on personal finances for doctors to help her colleagues also achieve financial success. DWM firmly believes that financial freedom makes better and happier doctors. DMW is featured websites including White Coat Investor and nonclinicaldoctors.com. You can follow DWM at drwisemoney.com. Email me at [email protected] for more information. |

Career Advice From the Experts and Leaders in Healthcare Careers

Contents

|

Information

|

Stay Connected

|